Maryland Cheapest Car Insurance & Best Coverage Options

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Joel Ohman

Founder, CFP®

Joel Ohman is the CEO of a private equity-backed digital media company. He is a CERTIFIED FINANCIAL PLANNER™, author, angel investor, and serial entrepreneur who loves creating new things, whether books or businesses. He has also previously served as the founder and resident CFP® of a national insurance agency, Real Time Health Quotes. He also has an MBA from the University of South Florid...

UPDATED: Jun 24, 2022

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

UPDATED: Jun 24, 2022

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

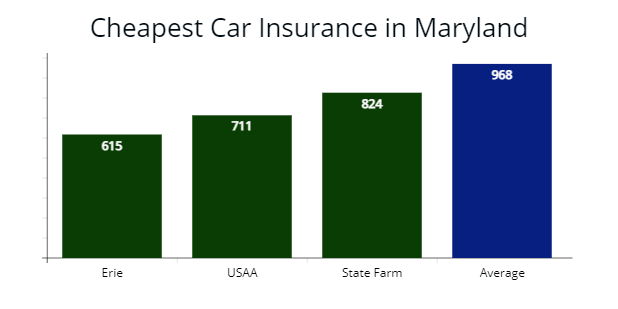

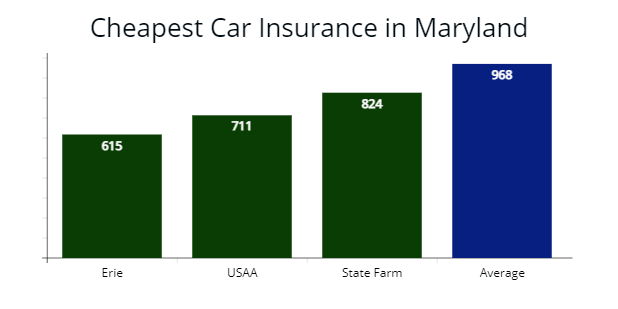

AutoInsureSavings.org licensed insurance agents did a comparison study of the cheapest car insurance companies in Maryland and found Erie Insurance at $615 per year provides the cheapest rate for Maryland minimum coverage.

State Farm at $1,768 per year provides the most affordable auto insurance for drivers in Maryland with full coverage policies.

Table of Contents

Best Cheap Car Insurance in Maryland

Drivers can find the best coverage in Maryland and save more on car insurance premiums by comparing quotes from multiple insurance providers with our comparison study’s best rates.

| Cheapest Car Insurance in Maryland - Key Takeaways |

|---|

The cheapest Maryland car insurance options are: The cheapest Maryland car insurance options are:Cheapest for minimum coverage: Erie Insurance Cheapest for full coverage: State Farm Cheapest after an at-fault accident: Progressive Cheapest after a speeding ticket: Erie Cheapest after a DUI: Progressive Cheapest with poor credit history: GEICO Cheapest for young drivers: Erie For younger drivers with a speeding violation: State Farm For younger drivers with an at-fault accident: Progressive |

This Maryland car insurance guide is the best way to find affordable car insurance coverage and help you save money regardless of age groups or driving types.

Cheapest Car Insurance in Maryland for Minimum Coverage

During our auto insurers’ analysis of Maryland’s best rates, Erie provided us a $615 per year or $51 per month for the cheapest minimum liability insurance for good drivers in Maryland. Erie’s quote is 37% cheaper than Maryland’s state average of $968 per year.

| Company | Average annual rate |

|---|---|

| Erie | $615 |

| USAA | $711 |

| State Farm | $824 |

| MetLife | $850 |

| Progressive | $986 |

| GEICO | $1,028 |

| Allstate | $1,091 |

| Nationwide | $1,148 |

*USAA is for qualified military members, their spouses, and direct family members. Rates may vary depending on driver profiles.

In Maryland, minimum liability coverage can ensure you have bodily injury, property damage liability, personal injury protection, and uninsured motorist coverage to stay legal and have the cheapest possible premium. Still, it may not provide you with all the coverage you need if you are involved in an auto accident.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

In the event of an at-fault car accident, state minimum policies will not cover property damage to your car. To avoid expensive repairs, our licensed agents recommend full coverage policies when shopping for Maryland auto insurance rates.

Cheapest Full Coverage Car Insurance in Maryland

State Farm offers the cheapest insurance rates for full coverage in Maryland for drivers with clean driving records. State Farm offered our sample driver a $1,768 annual rate or 17% less per year than Maryland’s average at $2,115 per year.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| State Farm | $1,768 | $147 |

| Erie | $1,865 | $155 |

| MetLife | $1,942 | $161 |

| Maryland average | $2,115 | $176 |

Full coverage policies offer a better coverage level of protection for Maryland drivers, which covers property damage to the other driver’s car and your car by adding collision and comprehensive coverage.

Collision coverage pays for damage to your motor vehicle in the event of an auto accident, and comprehensive insurance pays for weather damage, such as from a storm or fallen tree branch or if you accidentally hit an animal.

Cheapest Car Insurance With a Speeding Ticket for Drivers in Maryland

AutoInsureSavings insurance agents found Erie ($1,930 per year) offers cheaper car insurance in Maryland for drivers who have one speeding violation on their driving record. Erie’s quote is 24% less expensive or $589 less per year.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Erie Insurance | $1,930 | $160 |

| Progressive | $2,035 | $169 |

| State Farm | $2,262 | $188 |

| Maryland average | $2,519 | $209 |

In Maryland, traffic tickets give rate increases by $404 or 17%, but not as much as a driver with an at-fault accident (44%) or DUI violation (58%).

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

Cheapest Insurance with an Auto Accident in Maryland

We found Progressive offers cheaper car insurance quotes to Maryland drivers with one at-fault accident on their driving records with a $2,490 annual rate ($207 per month) for our sample 30-year-old male driver.

Progressive’s rate is $990 less per year than Maryland’s state average rate of $3,480 or 29% less expensive.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Progressive | $2,490 | $207 |

| State Farm | $2,537 | $211 |

| GEICO | $3,031 | $252 |

| Maryland average | $3,480 | $290 |

We found car insurance rates increase about 40% after a driver is involved in an accident in Maryland during our licensed agent’s analysis. Just one at-fault accident could cause your car insurance rates to increase as much as $1,365 per year or $112 per month.

Cheapest Car Insurance for People With a DUI in Maryland

With a drunk driving (DUI) violation, people in Maryland can find affordable car insurance with Progressive with a quote at $2,195 per year for full coverage or a $182 monthly rate for our sample 30-year-old driver. Progressive’s quote is 29% cheaper than Maryland’s DUI rate of $3,058 annually.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Progressive | $2,195 | $182 |

| Erie Insurance | $2,380 | $198 |

| State Farm | $2,571 | $214 |

| Maryland average | $3,058 | $254 |

According to Maryland.gov, a DUI conviction in Maryland will cause your car insurance premiums to increase by 31%. The DUI will remain on your driving record for three years, and you will be required to participate in Maryland’s ignition interlock program.

Cheapest Insurance for Drivers with Poor Credit in Maryland

According to our analysis, the Maryland car insurance company offering the best rates with poor credit is GEICO.

GEICO’s quote of $2,590 per year is 19% less expensive than state average rates of $3,160 per year for minimum liability requirements.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| GEICO | $2,590 | $215 |

| Progressive | $2,614 | $217 |

| State Farm | $2,830 | $235 |

| Maryland average | $3,160 | $263 |

Cheapest Car Insurance for Young Drivers in Maryland

Young Maryland drivers can find the cheapest full coverage auto insurance rates with Erie, which provided us a $6,047 annual rate or 18% less expensive than Maryland’s younger driver average rates.

Erie provides the cheapest minimum coverage rates for young or teen drivers at $1,628 per year or 47% lower than average Maryland rates.

The next best option for young Maryland drivers for state minimum is MetLife, at $1,745 per year. Of course, a teen driver must still meet the minimum coverage requirements for the state.

*USAA is for qualified military members, their spouses, and direct family members. Rates may vary depending on driver profiles.

According to the Insurance Information Institute (III.org), your age correlates with safe driving habits. Statistically, the younger you are, the higher likelihood you will be in a car accident.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

According to the National Highway Traffic Safety Administration (NHTSA), auto insurers account for this risk factor by charging higher insurance rates for inexperienced drivers. As you gain more driving experience, your rates should decrease as you get older.

Cheapest Insurance for Young Drivers with Speeding Tickets

Teen drivers with speeding tickets in Maryland can find the cheapest quotes with State Farm. Average auto insurance costs with State Farm are $6,925 per year for full coverage or 16% less expensive than Maryland’s average speeding ticket rate for younger drivers.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| State Farm | $6,925 | $577 |

| Progressive | $7,231 | $602 |

| GEICO | $7,900 | $658 |

| Maryland average | $8,220 | $685 |

Cheapest Insurance for Young Drivers with an At-fault Accident

Inexperienced Maryland drivers with a recent at-fault accident can find the best car insurance with Progressive with a $7,319 quote for full coverage insurance.

Progressive’s at-fault accident rate for young drivers is 15% cheaper than Maryland’s average rate of $8,603 per year.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Progressive | $7,319 | $609 |

| Erie Insurance | $7,537 | $628 |

| GEICO | $8,175 | $681 |

| Maryland average | $8,603 | $716 |

Best Auto Insurance Companies in Maryland

Based on customer service and claims satisfaction, Maryland’s best car insurance companies are USAA, State Farm, and Erie Insurance.

If customer service is a priority with a low amount of complaints based on NAIC’s index, we recommended State Farm as the best auto insurer in Maryland.

| Company | % respondents extremely satisfied with recent claim | % respondents rated customer service as excellent |

|---|---|---|

| USAA | 77% | 60% |

| Erie Insurance | 75% | 64% |

| State Farm | 72% | 53% |

| Allstate | 71% | 48% |

| Progressive | 74% | 39% |

| GEICO | 64% | 56% |

| MetLife | 62% | 44% |

Buying cheap insurance helps Maryland insurance shoppers save money, but insurance companies with poor customer service or claims handling sometimes are not worth the extra savings in your bank account.

AutoInsureSavings licensed agents collected information on Maryland’s car insurance companies from the National Association of Insurance Commissioners (NAIC), J.D. Power, and A.M. Best’s financial strength ratings.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

The insurance companies with the lowest NAIC complaint index ratio based on the market share are State Farm (0.66), USAA (0.98), and GEICO (1.02). State Farm and USAA have a complaint index of less than one (1.00), the national average, while GEICO is slightly above the national average.

| Auto insurer | NAIC complaint index | J.D. Power claims satisfaction score | AM Best financial strength rating |

|---|---|---|---|

| State Farm | 0.66 | 881 | A++ |

| USAA | 0.98 | 890 | A++ |

| GEICO | 1.02 | 871 | A++ |

| Allstate | 1.07 | 876 | A+ |

| Erie | 1.10 | 880 | A+ |

| Progressive | 1.64 | 856 | A+ |

While you shop around for car insurance companies in The Free State, several factors contribute to your insurance cost. Your driver profile, type of vehicle, and age can impact your total monthly or annual insurance premium.

It is always best to shop around and compare plans to find a Maryland car insurance company with the cheapest rates with excellent customer service ratings. Ask your insurer about additional discounts that might help you secure a cheaper rate.

Average Car Insurance Cost by City in Maryland

We collected insurance quotes from Maryland zip codes from top auto insurance companies, and found rates can vary by $518 by zip code and city.

Your zip code in The Free State is one of many risk factors auto insurers use to set your auto insurance quotes. Other factors include your marital status, type of vehicle, age, and liability insurance minimum limits. You should compare your personalized quotes based on the type of coverage you are offered. Policy offerings for minimum requirements have more affordable rates, but it’s always wise to consider additional coverage.

Cheapest Auto Insurance in Baltimore, MD

Drivers in Baltimore can find the best auto insurance rates with Progressive, which provided us a quote at $1,932 per year for a full coverage insurance policy. Progressive’s rate is 20% cheaper than Baltimore’s insurance rate of $2,390 per year.

| Baltimore Company | Average Premium |

|---|---|

| Progressive | $1,932 |

| Erie | $1,980 |

| GEICO | $2,038 |

| Baltimore average | $2,390 |

Cheapest Auto Insurance in Columbia, MD

AutoInsureSavings’ agents found Erie is the cheapest liability car insurance company for people in Columbia. They provided us a $1,824 per year rate for full coverage, 24% less expensive than Columbia’s average rates at $2,373 per year.

| Columbia Company | Average Premium |

|---|---|

| Erie Insurance | $1,824 |

| Progressive | $1,941 |

| MetLife | $2,160 |

| Columbia average | $2,373 |

Cheapest Auto Insurance in Germantown, MD

Germantown drivers can find the best full coverage insurance policy with State Farm, which provided us a quote at $1,723 per year or $143 per month. State Farm’s insurance quote is 24% cheaper than average rates for 30-year-old drivers in Germantown.

| Germantown Company | Average Premium |

|---|---|

| State Farm | $1,723 |

| Erie | $1,835 |

| GEICO | $2,049 |

| Germantown average | $2,260 |

Cheapest Auto Insurance in Silver Spring, MD

Through research, we found the cheapest auto insurance in Silver Spring is Progressive, with a $145 monthly rate or $1,740 per year. Progressive’s lowest rate is 25% less expensive than Silver Spring’s average rates of $2,264 per year.

| Silver Spring Company | Average Premium |

|---|---|

| Progressive | $1,740 |

| Erie | $1,789 |

| Allstate | $2,136 |

| Silver Spring average | $2,264 |

Cheapest Auto Insurance in Ellicott City, MD

Ellicott City drivers can find the cheapest auto insurance quotes with Erie, which provided our agents a $1,682 rate per year for our 30-year-old driver. Erie’s quote is 19% less expensive than Ellicott City’s average rates.

| Ellicott City Company | Average Premium |

|---|---|

| Erie Insurance | $1,682 |

| MetLife | $1,827 |

| GEICO | $1,940 |

| Ellicott City average | $2,063 |

Cheapest Auto Insurance in Frederick, MD

Drivers in Frederick looking for cheaper car insurance rates should get quotes from Erie, which offered our agents a $1,715 annual rate for full coverage with $500 deductibles with collision and comprehensive coverage. Erie’s rate is 20% less expensive than Frederick’s average rates of $2,127 per year.

| Frederick Company | Average Premium |

|---|---|

| Erie Insurance | $1,715 |

| State Farm | $1,866 |

| GEICO | $2,049 |

| Frederick average | $2,127 |

Average Car Insurance Costs for All Cities in Maryland

| City | Annual insurance cost | City | Annual insurance cost |

|---|---|---|---|

| Baltimore | $2,390 | Severn | $2,009 |

| Columbia | $2,373 | Wheaton | $1,947 |

| Germantown | $2,260 | North Bethesda | $2,032 |

| Silver Spring | $2,264 | Bel Air South | $2,147 |

| Waldorf | $2,163 | Potomac | $2,016 |

| Ellicott City | $2,063 | Odenton | $2,054 |

| Frederick | $2,127 | Catonsville | $1,889 |

| Glen Burnie | $1,899 | Woodlawn | $1,884 |

| Gaithersburg | $2,036 | Hagerstown | $1,990 |

| Rockville | $1,957 | Essex | $2,044 |

| Bethesda | $2,055 | Annapolis | $2,150 |

| Dundalk | $2,112 | Clinton | $2,178 |

| Bowie | $2,170 | Severna Park | $2,058 |

| Towson | $2,084 | Chillum | $1,864 |

| Aspen Hill | $1,976 | Randallstown | $1,822 |

| Olney | $1,896 | Chestertown | $1,887 |

| Owings Mills | $1,931 | Manchester | $1,840 |

| Montgomery Village | $1,947 | Centreville | $1,988 |

| Pikesville | $1,986 | Seat Pleasant | $1,914 |

| Salisbury | $2,019 | Deale | $1,896 |

| College Park | $2,049 | Chester | $1,931 |

| Bel Air North | $1,947 | Berlin | $2,166 |

| Parkville | $1,882 | Hampton | $2,049 |

| Eldersburg | $1,822 | Middletown | $1,896 |

| Carney | $1,973 | Woodmore | $1,864 |

| Milford Mill | $2,022 | Peppermill Village | $1,896 |

| Pasadena | $1,864 | Capitol Heights | $1,822 |

| Crofton | $2,049 | Denton | $2,070 |

| South Laurel | $1,896 | Perryville | $1,840 |

| Perry Hall | $2,071 | Kingsville | $1,973 |

| Reisterstown | $2,089 | West Laurel | $2,087 |

| Ilchester | $1,914 | Fulton | $2,016 |

| Lochearn | $2,090 | West Ocean City | $1,947 |

| Laurel | $2,097 | National Harbor | $1,896 |

| Edgewood | $1,822 | Melwood | $1,896 |

| Fairland | $2,016 | Riva | $1,882 |

| Middle River | $1,896 | Pocomoke City | $1,864 |

| North Laurel | $2,149 | Sykesville | $1,991 |

| Clarksburg | $2,083 | Brookmont | $1,822 |

| Suitland | $1,840 | St. James | $1,896 |

| Fort Washington | $2,100 | Indian Head | $1,931 |

| North Potomac | $2,058 | Pleasant Hills | $2,049 |

| Arnold | $2,116 | Leonardtown | $2,127 |

| Greenbelt | $1,896 | North East | $1,914 |

| Landover | $1,864 | Boonsboro | $1,991 |

| Camp Springs | $1,947 | Grasonville | $1,896 |

| Elkridge | $1,882 | Princess Anne | $1,931 |

| Ballenger Creek | $1,914 | Huntingtown | $1,890 |

| Cockeysville | $1,822 | Brentwood | $2,083 |

| Rosedale | $1,896 | Marlboro Meadows | $1,973 |

| Lake Shore | $2,049 | La Vale | $1,840 |

| Cumberland | $1,931 | Berwyn Heights | $1,864 |

| Langley Park | $1,991 | Delmar | $1,822 |

| Arbutus | $1,947 | Springdale | $2,016 |

| White Oak | $2,096 | Emmitsburg | $2,058 |

| Seabrook | $1,933 | Andrews AFB | $1,896 |

| Westminster | $2,128 | Paramount-Long Meadow | $1,882 |

| Hyattsville | $1,864 | Golden Beach | $1,896 |

| Oxon Hill | $2,096 | Jarrettsville | $2,122 |

| Beltsville | $1,916 | Chevy Chase | $2,036 |

| Takoma Park | $2,083 | Smithsburg | $1,991 |

| Maryland City | $1,822 | Prince Frederick | $1,864 |

| Redland | $2,117 | Braddock Heights | $1,947 |

| Ferndale | $1,840 | Aberdeen Proving Ground | $1,896 |

| Parole | $1,896 | Greensboro | $1,931 |

| Glassmanor | $2,124 | Gambrills | $1,822 |

| Calverton | $1,882 | Rising Sun | $2,016 |

| Glenmont | $1,973 | Herald Harbor | $1,896 |

| Easton | $2,128 | Federalsburg | $2,117 |

| East Riverdale | $1,864 | University Park | $1,840 |

| Hillcrest Heights | $1,920 | Dunkirk | $2,096 |

| Adelphi | $1,864 | North Beach | $2,083 |

| Aberdeen | $1,896 | Crisfield | $1,991 |

| Elkton | $1,822 | Forest Heights | $2,049 |

| Cloverly | $2,149 | Maugansville | $2,058 |

| Damascus | $2,128 | Konterra | $1,882 |

| Rossville | $1,840 | Owings | $2,128 |

| Brooklyn Park | $1,896 | Adamstown | $1,822 |

| California | $1,947 | Perryman | $2,128 |

| Kemp Mill | $1,856 | Hughesville | $1,931 |

| Summerfield | $2,136 | Wilson-Conococheague | $2,124 |

| Colesville | $2,117 | Jefferson | $1,896 |

| Havre de Grace | $2,096 | Drum Point | $1,991 |

| Kettering | $2,083 | Mountain Lake Park | $1,864 |

| Glenn Dale | $1,919 | Croom | $2,124 |

| Bensville | $2,058 | Westernport | $2,096 |

| New Carrollton | $1,864 | Snow Hill | $1,931 |

| Riviera Beach | $1,882 | Long Beach | $2,117 |

| Urbana | $1,822 | Solomons | $1,973 |

| Annapolis Neck | $1,896 | Cabin John | $1,947 |

| Ocean Pines | $1,991 | Kensington | $1,896 |

| Cambridge | $2,049 | Spencerville | $1,840 |

| Forestville | $2,128 | Hurlock | $1,822 |

| Joppatowne | $2,128 | Williamsport | $1,864 |

| Mays Chapel | $2,096 | Chevy Chase Village | $2,016 |

| Overlea | $1,918 | Myersville | $2,128 |

| Brock Hall | $1,947 | Queensland | $2,083 |

| Accokeek | $1,896 | Kingstown | $2,163 |

| Mitchellville | $2,058 | Landover Hills | $1,882 |

| Travilah | $1,864 | Derwood | $2,118 |

| Lanham | $1,991 | Arden on the Severn | $2,124 |

| Lexington Park | $1,822 | Charlotte Hall | $1,896 |

| Largo | $2,096 | Point of Rocks | $2,058 |

| Walker Mill | $1,864 | Lusby | $2,016 |

| Halfway | $1,914 | Mechanicsville | $1,931 |

| Fort Meade | $2,117 | Oakland | $2,151 |

| Timonium | $1,840 | Baden | $1,822 |

| Rosaryville | $1,896 | Ridgely | $2,083 |

| Linthicum | $1,882 | Bartonsville | $2,128 |

| Bel Air town | $2,124 | Hancock | $1,947 |

| Friendly | $1,991 | Bel Air | $2,096 |

| Lake Arbor | $1,822 | Fairmount Heights | $1,896 |

| Westphalia | $2,049 | New Market | $1,973 |

| Brandywine | $2,128 | Pittsville | $1,840 |

| Burtonsville | $1,973 | Crownsville | $1,864 |

| Scaggsville | $2,016 | Charlestown | $2,058 |

| Chesapeake Ranch Estates | $2,083 | Edmonston | $2,120 |

| Chevy Chase | $2,036 | Rock Hall | $1,822 |

| Jessup | $2,096 | Cottage City | $2,129 |

| Bladensburg | $2,128 | New Windsor | $2,124 |

| Mount Airy | $1,896 | Potomac Heights | $2,047 |

| La Plata | $1,947 | Buckeystown | $2,016 |

| Marlboro Village | $2,096 | Lonaconing | $1,896 |

| White Marsh | $1,973 | Morningside | $2,016 |

| Edgewater | $1,864 | Algonquin | $1,914 |

| Linganore | $1,822 | Bowling Green | $1,840 |

| Marlton | $1,882 | Highland | $1,931 |

| Leisure World | $2,058 | Trappe | $1,973 |

| North Kensington | $1,896 | Colmar Manor | $1,822 |

| Fallston | $2,119 | Woodsboro | $1,864 |

| South Kensington | $1,840 | Cavetown | $2,049 |

| Cape St. Claire | $1,931 | Hebron | $2,128 |

| Coral Hills | $2,083 | St. Michaels | $1,896 |

| Frostburg | $2,124 | Somerset | $2,137 |

| Edgemere | $1,947 | Pylesville | $2,117 |

| Lansdowne | $1,914 | Keedysville | $2,129 |

| Garrison | $1,822 | Queen Anne | $2,096 |

| Four Corners | $1,864 | Martin's Additions | $2,058 |

| Mount Rainier | $1,991 | Chevy Chase View | $2,036 |

| Mayo | $2,047 | Tilghman Island | $1,884 |

| Baltimore Highlands | $2,128 | Libertytown | $1,822 |

| Temple Hills | $2,096 | Mount Vernon | $1,840 |

| Bryans Road | $1,896 | Calvert Beach | $2,083 |

| Robinwood | $2,058 | Funkstown | $1,973 |

| Stevensville | $2,133 | Aquasco | $1,896 |

| Riverdale Park | $2,096 | Monrovia | $1,931 |

| Ocean City | $1,914 | Willards | $1,864 |

| Lutherville | $1,973 | Cecilton | $1,947 |

| Taneytown | $1,822 | Garrett Park | $2,124 |

| Woodlawn | $2,117 | Union Bridge | $1,931 |

| Thurmont | $1,885 | Tilghmanton | $1,991 |

| Hillandale | $2,049 | Cobb Island | $2,136 |

| Forest Glen | $2,083 | Potomac Park | $1,822 |

| Darnestown | $1,840 | Queenstown | $2,117 |

| Cheverly | $1,864 | Highfield-Cascade | $2,047 |

| Savage | $1,896 | Church Hill | $2,050 |

| Bowleys Quarters | $1,914 | Piney Point | $2,111 |

| Hampstead | $1,947 | Sharpsburg | $1,931 |

| Fairwood | $2,058 | Bishopville | $1,864 |

| Brunswick | $1,973 | Upper Marlboro | $2,099 |

| Walkersville | $1,822 | Finzel | $1,953 |

| Glenarden | $2,049 | Eden | $1,840 |

| Riverside | $2,092 | North Brentwood | $1,938 |

| District Heights | $1,973 | Mount Savage | $1,882 |

| Ashton-Sandy Spring | $1,864 | Preston | $1,822 |

| Naval Academy | $1,840 | Chevy Chase Section Three | $2,036 |

| Chesapeake Beach | $1,914 | Chesapeake City | $2,007 |

| Cresaptown | $1,947 | Midland | $2,058 |

| Spring Ridge | $2,083 | Millington | $1,864 |

| Marlow Heights | $1,882 | Washington Grove | $2,047 |

| Fountainhead-Orchard Hills | $1,994 | McCoole | $1,973 |

| Shady Side | $1,822 | Sharptown | $1,880 |

| Friendship Heights Village | $1,963 | Mount Aetna | $1,939 |

| Fruitland | $1,977 | Eckhart Mines | $1,914 |

| Layhill | $1,896 | Galena | $1,840 |

| Poolesville | $1,864 | Galesville | $1,822 |

| Silver Hill | $1,845 | Grantsville | $1,880 |

Minimum Car Insurance Coverage Requirements in Maryland

According to state law and the Maryland Department of Transportation, all drivers must carry the minimum liability insurance requirements, personal injury protection (PIP) of $2,500 per person and per accident, and uninsured motorist coverage.

| Maryland car insurance requirements | Minimum coverage limits |

|---|---|

| Bodily injury liability | $30,000 per person / $60,000 per accident |

| Property damage liability | $15,000 per accident |

| Uninsured/underinsured motorist bodily injury | $30,000 per person / $60,000 per accident |

| Uninsured/underinsured motorist property damage | $15,000 per accident with $250 deductible |

| Personal injury protection (PIP) | $2,500 minimum |

*Motor vehicle drivers can opt to waive Personal Injury Protection (PIP) in writing.

The insurance requirements pay for bodily injury and property damage sustained to other people or motor vehicles. Uninsured motorist coverage pays for accidents with uninsured motorists, and personal injury protection pays for medical expenses to you or other vehicle occupants. AutoInsureSavings agents recommend higher bodily injury and property damage liability limits with comprehensive and collision insurance.

Frequently Asked Questions

Who has the Cheapest Car Insurance in Maryland?

We found the top car insurance companies that offer the lowest Maryland driver’s average rates are Erie Insurance at $51 per month, USAA at $59 per month, and State Farm at $68 a month for a liability insurance policy for a 30-year-old with clean driving history.

How Much Is Car Insurance For Drivers in Maryland per Month?

The average cost for car insurance per month in Maryland is $176 or $2,115 per year for full coverage. The average price of a minimum coverage car insurance policy per month is $74 or $968 per year. State Farm’s full coverage average rate is $147 per month or 17% less expensive, while Erie offers state minimum coverage insurance in Maryland at $51 per month or 37% cheaper.

How Much Is Full Coverage Car Insurance in Maryland?

The average cost of full coverage car insurance in Maryland is $2,115 annually or $176 per month. State Farm’s average rate for full coverage is $1,768 per year or $147 per month. Erie Insurance ($1,865) and MetLife ($1,942) are also below the state average rates.

How do I Save on Car Insurance in Maryland?

There are many ways for drivers in Maryland to save on their car insurance premiums. You can determine if you are eligible for a money-saving driver discount offered by the car insurance company. Many insurance providers will lower your overall rates if you have multi-policies with them, such as life or home insurance.

Another way to save on your car insurance premium is to practice good driving habits and keep a clean driving record. That will not only keep you and your passengers safe but will also help you avoid auto accidents or traffic violations that could cause rate increases.

To learn more about the most affordable car insurance options for drivers in Maryland, contact the experts at AutoInsureSavings.org. Our licensed insurance professionals will be happy to answer any questions you have.

Methodology

AutoInsureSavings.org comparison shopping insurance study used a full-coverage auto policy for a 30-year-old driving a 2018 Honda Accord with the following coverage limits:

Average Coverage Limits for Full-Coverage Auto Policy

| Coverage type | Study limits |

|---|---|

| Bodily injury liability | $50,000 per person / $100,000 per accident |

| Property damage liability | $25,000 per accident |

| Personal injury protection | $10,000 |

| Uninsured / underinsured motorist bodily injury | $50,000 per person / $100,000 per accident |

| Comprehensive and collision coverage | $500 deductible |

We used insurance rates for drivers with accident histories, credit scores, and marital status for other Maryland rate analyses. We used car insurance rate data from Quadrant Information Services, which are publicly available for comparative purposes only. Your insurance rates may vary when you get quotes.

Sources

– National Association of Insurance Commissioners. “Market Share Reports for Property/Casualty Groups and Insurance Companies.”

– Maryland Insurance Administration. “A Consumer Guide to Auto Insurance.”

– Maryland Motor Vehicle Administration. “Impaired Driving Laws.”

– District Court of Maryland. “Department of Transportation.”

– Insurance Information Institute. “Compulsory on Auto/Uninsured Motorists.”

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Joel Ohman

Founder, CFP®

Joel Ohman is the CEO of a private equity-backed digital media company. He is a CERTIFIED FINANCIAL PLANNER™, author, angel investor, and serial entrepreneur who loves creating new things, whether books or businesses. He has also previously served as the founder and resident CFP® of a national insurance agency, Real Time Health Quotes. He also has an MBA from the University of South Florid...

UPDATED: Jun 24, 2022

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.